The IRS is not enforcing the law on political nonprofit disclosure violations

The IRS is not enforcing the law

Over and over, blatant violations of the law by 501(c)(4) groups have been brought to the IRS’s attention, many of which the agency should be able to easily assess and navigate. This report examines some of the most egregious examples of these violations.

The Supreme Court’s decision in Citizens United v. FEC ushered in a new era of massive dark money political spending. In the 2020 election cycle alone, more than $1 billion was spent on federal campaigns that could not be traced back to its true source. Much of that spending was hidden from public view because it was done by a particular kind of entity: social welfare organizations exempt from taxation under section 501(c)(4) of the tax code.

The Internal Revenue Service (IRS) is supposed to play a vital role overseeing these groups, including by guaranteeing at least some transparency about their activities. While tax law does not require section 501(c)(4) organizations to disclose their contributors, they are obligated to file annual tax returns that are open to the public and provide one of the only windows into what these groups are up to. These disclosures offer important information about the structure and political activities of dark money organizations, and are critical for IRS tax law enforcement, including the requirement that these groups may not make politics their primary activity.

Unfortunately, the IRS has done a poor job enforcing these laws on section 501(c)(4) groups. According to a 2020 Government Accountability Office report, between 2010 and 2017, the IRS conducted and closed 226 examinations related to tax-exempt organizations’ failures to comply with the rules on political campaign activity. But only 14 of those examinations involved section 501(c)(4) organizations — the vast majority instead dealt with section 501(c)(3) charitable organizations that are “absolutely prohibited” from participating in any campaign activity. In fact, for much of the time since Citizens United, the IRS didn’t revoke any section 501(c)(4) group’s tax-exempt status for violating the law’s limits on their political spending. The sharp rise in political activity unleashed by Citizens United combined with the IRS’s lax enforcement has led some observers to believe that the IRS has given up on this part of its job.

The IRS appears to have been notably lenient in enforcing the basic rules on disclosure and transparency by section 501(c)(4) groups engaged in politics. CREW and others have identified dozens of these kinds of violations, many of which were brought directly to the IRS’s attention through complaint letters to the agency. Some section 501(c)(4) groups, for example, disclosed their political spending to the Federal Election Commission (FEC) and other government agencies, but told the IRS under penalty of perjury in their tax returns that they did not engage in any political activity or misrepresented the amount they spent. Others simply failed to file their tax returns or filed them only after complaints were filed against them.

The IRS appears to have taken little if any serious action to take on these types of straightforward violations. Just this month, IRS Commissioner Charles Rettig told the Senate Finance Committee that he believed the IRS has never referred to the Department of Justice a single case of a tax-exempt organization disclosing political spending to another agency then falsely telling the IRS under penalty of perjury it had not done any. And while confidentiality rules prevent the IRS from revealing when it takes enforcement action against tax-exempt groups, there is little public evidence that the agency has taken significant steps to address these disclosure issues.

Over and over, blatant violations of the law have been brought to the IRS’s attention, many of which the agency should be able to easily assess and navigate. This report examines some of the most egregious examples of these violations. It is in no way, however, a complete picture — there certainly are many other instances of these kinds of violations. We hope this report spurs the IRS to take action to deal with at least this kind of low-hanging fruit.

Table of contents

- IRS political disclosure and operational requirements for tax-exempt organizations

- Section 501(c)(4) organizations’ reporting violations and primary activity

- The IRS should get proactive now in enforcing compliance by political nonprofits

IRS political disclosure and operational requirements for tax-exempt organizations

The tax code imposes several legal requirements on tax-exempt organizations. To become tax-exempt, organizations must meet certain qualifications and abide by restrictions on their structure and operations. Groups that do obtain tax-exempt status are subject to disclosure requirements, most importantly that they file annual Form 990 informational tax returns. These returns are public documents, available either from the organization itself or the IRS.

There are three types of Form 990 tax returns. Most of the organizations examined in this report filed the full Form 990 tax return, which requires the most disclosure. Smaller organizations file the shorter Form 990-EZ. The smallest groups — those that normally have less than $50,000 in gross receipts — may instead choose to file Form 990-N, which requires disclosure of only the most basic information.

Tax-exempt organizations must disclose information about their political spending and other activities on the full Form 990 and Form 990-EZ. Organizations must declare if they engaged in any “direct or indirect political campaign activities on behalf of or in opposition to candidates for public office.” Form 990, Part IV, Line 3; Form 990-EZ, Part V, Line 46. If the answer is “yes,” the organization must complete and file a Schedule C (Political Campaign and Lobbying Activities) with their tax returns, which requires disclosure of “political expenditures.” 2021 Instructions for Form 990, at 12; 2021 Instructions for Schedule C, at 1, 3. Specifically, organizations must provide a description of its political campaign activities and the total amount spent on them. Schedule C, Part I-A. Groups that are not section 501(c)(3) charitable organizations must also report the amount they spent directly on “exempt function activities” (a legal term that covers political activity), the total amount they contributed to other organizations to conduct those activities, and the names and amounts given to each political organization. Schedule C, Part I-C.

Tax-exempt organizations also must declare whether they made more than $5,000 in grants or other assistance to any domestic organization. Form 990, Part IV, Line 21. If they did, they must complete and file a Schedule I with their tax returns. On Schedule I, organizations must disclose, among other things, that name of the organization that received the grant, the amount of the grant, the section of the tax code providing the grantee tax-exempt status (if applicable), and the purpose of the grant. Schedule I, Parts I & II.

Every Form 990 and Form 990-EZ is signed by an officer of the filing organization under penalty of perjury. Form 990, Part II, Form 990-EZ, Page 4. In the signature block, the signer declares: “Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.” Statements on Form 990s also are subject to federal criminal statutes prohibiting knowingly and/or willfully providing false material information on tax returns, as well as tax law provisions imposing civil liability on tax-exempt organizations that fail to provide correct information on their returns.

In addition to disclosure requirements, tax-exempt organizations have organizational and operational requirements and restrictions. This report examines section 501(c)(4) groups that are “not organized for profit but operated exclusively for the promotion of social welfare.” IRS regulations interpret the statute to mean a section 501(c)(4) organization must be “primarily engaged in promoting in some way the common good and general welfare of the people of the community.” The regulations further provide that political activity — described as “direct or indirect participation or intervention in political campaigns on behalf of or in opposition to any candidate for public office” — does not promote social welfare. When an advertisement explicitly advocates the election or defeat of an individual to public office, the expenditure unquestionably is political campaign activity. Similarly, contributions to political organizations are clearly direct or indirect participation or intervention in political campaigns. While the IRS has not formally defined the “primary activity” standard, it is widely understood to mean that a section 501(c)(4) organization may not spend more than 50 percent of its expenditures on political activities.

Section 501(c)(4) organizations’ reporting violations and primary activity

In the dozen years since the Citizens United decision opened the door to significantly increased political activity by section 501(c)(4) organizations, journalists and watchdog organizations have regularly identified groups who apparently have not fulfilled their reporting obligations to the IRS or may be violating their tax-exempt status with their high level of political spending. For instance, a 2012 investigation by ProPublica examined 107 nonprofits that had been active during the 2010 election, finding, among other things, that “[m]any groups told the IRS they spent far less on politics than they reported to federal election officials.” In another example, a 2015 analysis of tax returns by OpenSecrets found that 24 politically-active nonprofits had “devoted more than half their total spending to influencing elections in at least one year between 2008 and 2013,” and at least three had done so more than once.

Since 2011, CREW has filed numerous complaints with the IRS requesting investigations of whether politically-active section 501(c)(4) organizations failed to properly report their political activity or were operated primarily to influence elections. The next section includes five detailed case studies of CREW’s complaints and public reports of similar conduct, offering a non-exhaustive snapshot of the types of apparent violations the IRS appears to be taking little action to address. Additional summaries of similar conduct are at the end of the report.

Case study #1: National Rifle Association

Even before Citizens United, some section 501(c)(4) groups that reported political spending to the FEC told the IRS under penalty of perjury they did not engage in any political activity.

The National Rifle Association (NRA) has long been a significant player in national politics. The group is a membership organization with a variety of internal divisions, subsidiaries, and related organizations, and conducts its political activity through two entities: a political action committee and a section 501(c)(4) organization called the National Rifle Association Institute for Legislative Action. The political action committee is treated as a separate organization from the section 501(c)(4) entity and does not report its activities on the NRA’s tax returns.

As a section 501(c)(4) organization, the NRA could begin spending on independent expenditures that expressly advocated for the election or defeat of candidates in federal elections after the Citizens United decision in January 2010. Even before that, as a membership organization it could pay for communications to its members similarly advocating for and against federal candidates. Both types of spending must be disclosed to the FEC in periodic reports.

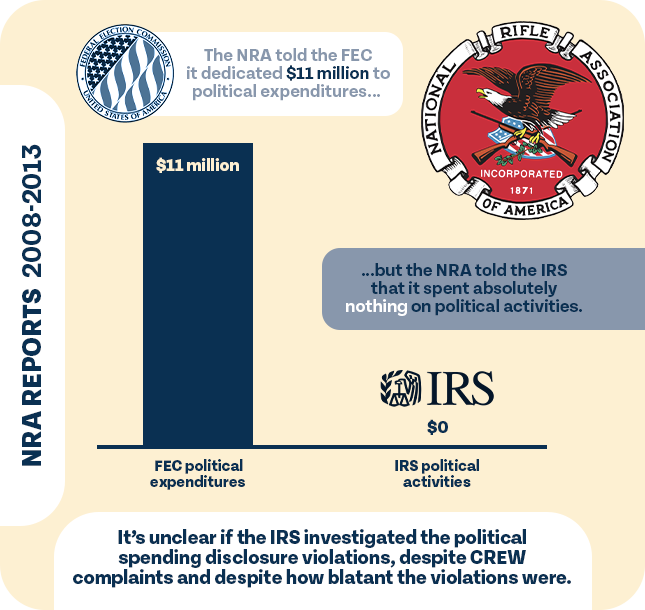

Between 2008 and 2013, the NRA reported to the FEC that it spent nearly $11 million in political expenditures. In 2012, it reported making $7.44 million in independent expenditures, more than half of which were spent opposing Barack Obama or supporting Mitt Romney in that year’s presidential race. The organization also reported to the FEC spending $1.21 million in communication costs for 2008, $1.08 million for the 2010 election cycle, $1.15 million for the 2012 election cycle, and $39,705 for 2013.

Remarkably, the NRA told the IRS under penalty of perjury that it spent absolutely nothing on political campaign activities between 2008 and 2013. Nor did it file a Schedule C disclosing details of its political spending in any of those years. The NRA later claimed its failure to report was the result of a “clerical error” in which “a box was erroneously left unchecked.” It also produced a check showing it paid the IRS taxes for its 2012 political spending. But the NRA did not address its failure to file any Schedule Cs, and did not say it had or intended to amend its Form 990 tax returns. In fact, to CREW’s knowledge, the NRA never amended any of those tax returns. Multiple news reports revealed the NRA’s failure to disclose its political spending on its Form 990 tax returns, and CREW filed a complaint with the IRS about the violations in June 2015 and later filed several related complaints.

This outside scrutiny may have resulted in more accurate disclosure by the NRA, although it remained muddled in 2014. For that year, the NRA reported to the FEC making $11.5 million in independent expenditures and spending $1.12 million in communication costs, bringing its total spending on expenditures expressly advocating the election or defeat of candidates for federal office to $12.63 million. In its tax return, the NRA acknowledged it had engaged in political spending, and filed a Schedule C disclosing on one line $5.79 million in direct and indirect spending on political activities. On another line, which is used for the normally narrower category of “exempt function activities,” the NRA oddly reported spending $13.34 million. It is unclear how the NRA calculated this amount.

The NRA’s disclosure failures, which were brought to the IRS’s attention by news reports and CREW’s complaints, were an early warning of extremely serious financial, governance, and tax problems. The New York Attorney General referred those allegations to the IRS in 2020, which reportedly launched an investigation into the NRA. It is unknown if the IRS investigated or even considered the political spending disclosure violations. But, a careful review of the NRA’s tax returns and practices may have uncovered some of these excesses earlier, or even deterred them.

Case study #2: Freedom Frontier

In 2016, a federal super PAC backing Sen. Lindsey Graham’s presidential campaign reported to the FEC that on November 25, 2015 it received a $250,000 contribution from a section 501(c)(4) social welfare organization called Freedom Frontier. Despite the super PAC’s disclosure of the six-figure contribution, Freedom Frontier filed a short form 990-N for its 2015 tax year, effectively declaring it took in $50,000 or less in revenue. As CREW noted in a report on the discrepancy, it appeared extremely unlikely that the group’s 2015 tax return was accurate, unless the super PAC misreported the contribution. The nonprofit subsequently confirmed its initial tax return was deeply defective when it filed an amended return a little over a month after CREW’s report was published. The new return disclosed that Freedom Frontier had actually raised more than $1.1 million in 2015, spent more than $870,000, and employed a political consulting firm that also worked for the super PAC the nonprofit helped fund.

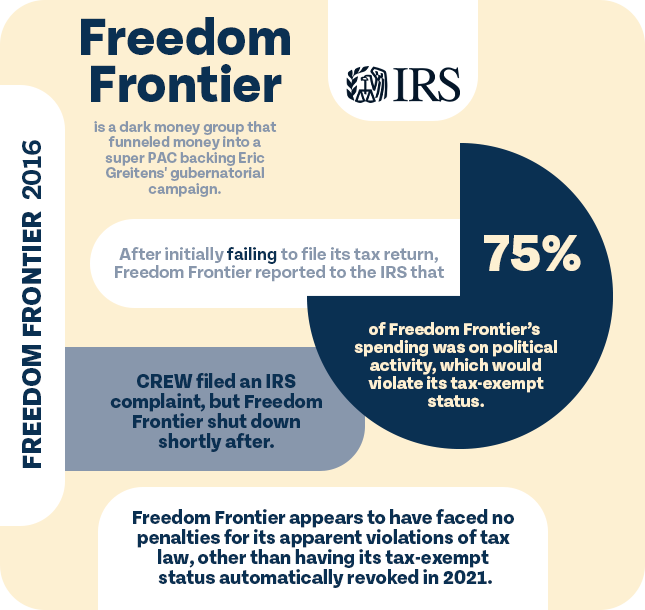

Freedom Frontier’s contradictory and ultimately false initial 2015 tax return was only the first issue related to the group’s political activity and tax reporting that deserved scrutiny from the IRS. In 2016, Freedom Frontier gained notoriety when a federal super PAC called LG PAC that supported now-former Missouri Gov. Eric Greitens in the Missouri GOP gubernatorial primary reported to the FEC that it was completely funded — to the tune of the nearly $4.4 million — by Freedom Frontier. When it came time to file its tax returns covering the year, both Freedom Frontier and another nonprofit affiliated with it called American Policy Coalition, which had also been disclosed in FEC reports as backing Greitens’ 2016 bid, failed to submit them to the IRS when they were due, denying the public important information about the groups’ activities. CREW filed complaints against both groups in March 2018 over their failure to file their returns on time.

Freedom Frontier eventually filed its 2016 Form 990 information return in July 2018, just days after CREW filed a complaint against the group with the FEC. The long-delayed tax return revealed that political activity accounted for 75 percent of Freedom Frontier’s total expenditures in 2016, an apparent violation of the organization’s tax-exempt status. CREW filed a complaint with the IRS in November 2018 requesting an investigation into whether the nonprofit operated primarily to influence political campaigns. According to OpenCorporates, Freedom Frontier terminated its corporate existence after CREW filed that complaint. Despite contributing more than $1 million to another super PAC in 2018, Freedom Frontier failed to ever file a tax return for the year, and the IRS auto-revoked the group’s tax-exempt status on May 15, 2021 after it failed to file a Form 990 three years in a row.

Case study #3: Prosperity Alliance, Inc.

In April 2018, a federally-registered super PAC called Conservative Alliance PAC began paying for media buys and direct mail targeting non-federal races. Soon enough, Conservative Alliance PAC ads and mail pieces began appearing in Ohio state House races. The barrage, which was completely funded by a Virginia-based section 501(c)(4) social welfare organization called Prosperity Alliance, Inc., targeted candidates aligned with now-indicted former Ohio House Speaker Larry Householder in the “proxy fight” between him and then-interim Ohio House Speaker Ryan Smith to be elected Speaker in the next term.

By the end of April, according to the super PAC’s reports to the FEC, Prosperity Alliance had made $475,000 in political contributions to Conservative Alliance PAC. But when Prosperity Alliance filed its tax return with the IRS covering May 1, 2017 through April 30, 2018, the nonprofit claimed it had not engaged in any political activity during that time and failed to file a Schedule C reporting the amount it spent on political expenditures. Instead, Prosperity Alliance disclosed the Conservative Alliance PAC contributions as grants on Schedule I, and described them as being given to a “[section] 527” political organization for “general support.” Beyond the importance of making accurate statements to the IRS, Prosperity Alliance’s denial of its political activity was particularly significant because the contributions accounted for 78.4 percent of the approximately $600,000 the nonprofit organization spent overall during its tax year, an apparent violation of the group’s tax-exempt status. CREW filed a complaint with the IRS in September 2019, requesting that the agency investigate whether Prosperity Alliance operated primarily to influence political campaigns and if it failed to properly disclose its political contributions.

Prosperity Alliance continued to fund Conservative Alliance PAC, with the super PAC ultimately reporting to the FEC that it received an additional $558,500 from the nonprofit, which it mainly used to pay for more independent expenditures in state races. When Prosperity Alliance filed its tax return covering the rest of 2018, the nonprofit again told the IRS it did not engage in any political activity and again failed to file a Schedule C, prompting CREW to file a supplement to its initial complaint.

As part of the updated complaint, CREW highlighted additional political spending beyond the reported super PAC contributions that Prosperity Alliance appeared to have engaged in during the time period covered by its first tax return. Specifically, an exhibit filed by Conservative Alliance PAC in a lawsuit brought against it by one of the candidates it targeted featured a research report that was used to make the ads. The cover of the “Research Findings Report,” which focused on the candidate and the political office he sought, suggested that it was “prepared for” Prosperity Alliance rather than Conservative Alliance PAC. The report was dated March 14, 2018, during Prosperity Alliance’s 2017 tax year. If Prosperity Alliance paid for political opposition research and provided it to Conservative Alliance PAC for free, it likely would be an in-kind contribution, which would increase the proportion of Prosperity Alliance’s spending dedicated to political activity even more.

Prosperity Alliance continues to be an active funder of super PACs. In 2022 so far, the group has given $200,000 to a federal super PAC called Americans for Secure Elections PAC that is supporting Ohio Secretary of State Frank LaRose in his re-election race, and $15,000 to a super PAC called Anne Arundel Forward.

Case study #4: Broken Promises

In 2020, Florida politics was roiled when three state Senate races were influenced by the presence of independent candidates who did little campaigning of their own but were promoted by political committees funded by a mysterious dark money group. Soon after the election, evidence emerged suggesting that the candidates were put forward to act as spoilers siphoning votes from Democratic candidates, and a former Republican state senator was eventually arrested for campaign finance violations related to his efforts to get one of the so-called “ghost” candidates to enter one of the races. Reporters digging into the mysterious money backing the candidates discovered that “nearly identical tactics — involving some of the same strategists” — were previously utilized in a 2018 Florida state Senate race.

In that 2018 race, Charles Goston, a lifelong Democrat and former Gainesville City Commissioner, sought Florida’s 8th Senate District seat as an independent, drawing speculation that he was in the race in order to siphon votes from the Democratic candidate. After entering the race, Goston reportedly didn’t actively campaign much and reportedly “remained unseen and unheard” until late September 2018, when mailers touting him to his former constituents began appearing. Goston was boosted by a PAC called Friends of Charles Goston that, according to the PAC’s filings with the Florida Department of State’s Division of Elections, received all of its funding from a section 501(c)(4) social welfare organization incorporated in August 2018 in Washington, D.C. called Broken Promises.

Including its direct and in-kind contributions to Friends of Charles Goston as well as a $25,000 contribution to another PAC called Consumers for Energy Fairness, Broken Promises contributed $160,470 to Florida-registered political committees in 2018, according to reports filed with the state’s Division of Elections. When Broken Promises filed its 2018 tax return, however, it told the IRS it did not participate in any political activity, failed to file a Schedule C, and even failed to report any contributions or grants it made to any other groups. The nonprofit reported spending $161,010 overall in 2018, meaning that the contributions reported in Florida campaign finance records accounted for a jaw-dropping 99.6 percent of the section 501(c)(4) group’s total spending in 2018. In December 2020, CREW filed a complaint against Broken Promises with the IRS, requesting that the agency investigate whether the nonprofit operated primarily to influence political campaigns and violated federal law by failing to properly disclose its political contributions. It appears that Broken Promises terminated its corporate existence soon after CREW filed its complaint.

Case study #5: Arizona Future Fund

Less than two weeks before the August 2014 Arizona Republican gubernatorial primary, a section 501(c)(4) tax-exempt organization called Arizona Future Fund placed newspaper advertisements effectively urging Arizonans to vote in the race for former Mesa Mayor Scott Smith. Around the same time, Arizona Future Fund’s Facebook page also advocated voting for Smith, saying, “On August 26, Arizona voters will go to the polls to elect the next Republican nominee for Governor – and the stakes couldn’t be any higher. That’s why Republicans and Independents agree: Arizona needs Scott Smith.” The post featured a video ad that declared, “There’s a better choice for Governor. Scott Smith.” A similarly worded ad was also posted on YouTube while the nonprofit paid for television ads targeting the governor’s race.

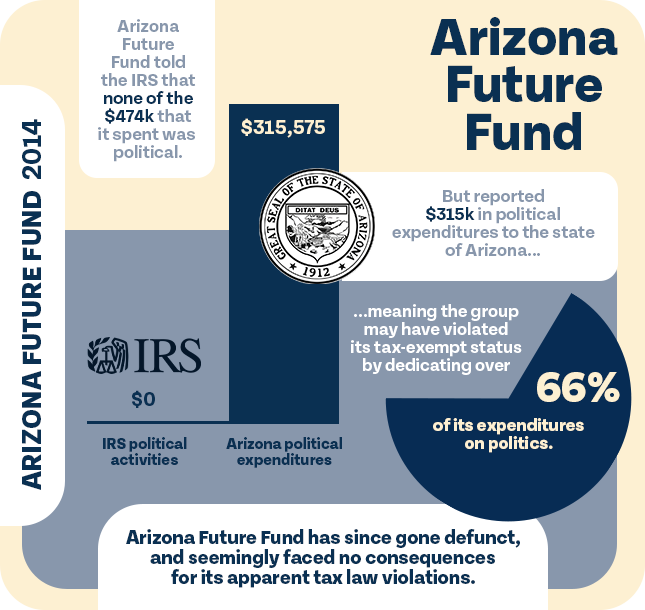

After the various ads began running, an attorney for one of Smith’s rivals filed several complaints against Arizona Future Fund with the Arizona Citizens Clean Elections Commission and the Arizona Secretary of State’s office arguing that the group had failed to register as an independent expenditure organization and to file the required disclosure reports. The Citizens Clean Elections Commission subsequently found that the ads “unequivocally constitute express advocacy under Arizona law and are independent expenditures on behalf of Scott Smith” and “had no reasonable meaning other than to advocate for the election of Smith for governor.” To resolve the matter, Arizona Future Fund entered into a conciliation agreement on December 18, 2014 that stated that the group “made independent expenditures and filed no reports” and acknowledged the violations set forth in the Statement of Reasons based on the fact that the ads constituted express advocacy and had no reasonable meaning other than to advocate for Smith’s election. The group agreed to pay a $10,000 fine and to file reports disclosing the independent expenditures. On December 23, 2014, Arizona Future Fund’s general counsel, a lawyer named William Canfield who had signed the conciliation agreement on behalf of the group, provided the Citizens Clean Elections Commission a copy of the reports it submitted to the Arizona Secretary of State, disclosing $315,575 the group spent on “independent expenditures” in the “Smith Governor 2014” race.

Months later, Arizona Future Fund submitted its 2014 tax return to the IRS, which was also signed by Canfield. Despite the conciliation agreement acknowledging the Smith advertisements were independent expenditures and the submitted disclosures detailing the spending on them, Arizona Future Fund told the IRS it did not engage in any political activity and failed to file a Schedule C reporting how much it spent influencing elections. The group reported spending a total of $474,600 in 2014, meaning that the $315,575 on independent expenditures acknowledged to the state of Arizona accounted for 66.5 percent of Arizona Future Fund’s total spending, an apparent violation of the group’s tax-exempt status. In June 2016, CREW filed a complaint against Arizona Future Fund with the IRS, requesting that the agency investigate whether the organization operated primarily to influence political campaigns and violated federal law by falsely representing it spent no money on political activity in 2014.

Arizona Future Fund terminated its activities on December 30, 2014, claiming in a resolution of its board that was attached to its tax return that “the social welfare purpose for which the association was created [was] achieved within calendar year 2014” and “no additional purpose exists as to which the association might become engaged.” The organization, however, had previously told the Citizens Clean Elections Commission it was terminating because “there is absolutely no prospect of the Fund being able to obtain additional donations going forward” because of the complaints that had been filed against it.

For more case summaries, click here to scroll to the end.

The IRS should get proactive now in enforcing compliance by political nonprofits

During his recent appearance before the Senate Finance Committee, IRS Commissioner Rettig agreed that the status quo when it comes to enforcement of tax law compliance by politically active nonprofits is “preposterous.” “We need to be present in all of these issues,” Commissioner Rettig said.

Hopefully this means the IRS is committed to improving enforcement in this area, since there are few signs dark money groups are going to stop seeking to influence elections anytime soon. If a Form 990 recently obtained by CREW is any indication, the tax agency should not have difficulty finding potential avenues for investigation in the returns submitted by nonprofit groups that were active in the 2020 election.

In 2020, a federally-registered super PAC called Protecting Ohio Action Fund that backed Ohio Gov. Mike DeWine’s daughter, Alice, in her failed effort to become the elected prosecuting attorney in Greene County, Ohio, reported to the FEC that it received nearly all of its funding — $421,781 — from a similarly named section 501(c)(4) nonprofit called Protecting Ohio, Inc. On its 2020 tax return, however, Protecting Ohio denied to the IRS that it engaged in any political activity and failed to file a Schedule C. The group also failed to report the super PAC contributions in the section meant for detailing grants to other organizations, claiming that it didn’t make any of those either.

Instead, Protecting Ohio reported spending nearly the same amount that the super PAC reported receiving from it on a line item for “payments to affiliates.” According to instructions for Form 990, the “payments to affiliates” line is for “certain types of payments to organizations affiliated with (closely related to) the filing organization.” Yet elsewhere on the return, Protecting Ohio denied having any related organizations to report. In fact, Protecting Ohio Action Fund is not mentioned anywhere on the tax return.

By failing to accurately report its political activity to the IRS, Protecting Ohio effectively concealed information that is crucial to determining the group’s compliance with its tax-exempt status. The $421,781 the so-called social welfare organization provided to a political organization accounted for 56 percent of the group’s total spending in 2020. Considering that Protecting Ohio only spent a little more than $10,000 in 2019 and the organization dissolved in May 2021, it appears that making political contributions may have been Protecting Ohio’s primary activity over the course of its entire existence.

This type of fact pattern, where an organization’s claims to the IRS are plainly inconsistent with its reporting to other government entities, should be straightforward for the IRS to pursue. Particularly so in a case like this, where inaccurate information in the return obscures whether a tax-exempt organization violated its tax status while allowing secretly sourced money to enter elections. We hope that Commissioner Rettig’s recognition of the IRS’s enforcement shortcomings and his commitment “to be present” in these issues signals a new and real effort to ensure that tax-exempt organizations fulfill their most basic obligations.

Additional case studies

Robert Maguire contributed to this report.

Header photo by David Boeke under a Creative Commons license.